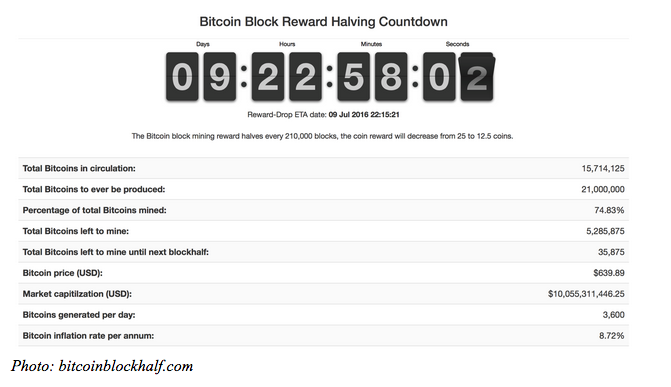

The media is awash in discussions of bitcoin as the cryptocurrency increasingly is seen alongside gold, the dollar and the yen as stores of value in times of uncertainty. Brexit has increased the concern just at the time that there is going to be a fundamental change in how bitcoins are generated. Known as the halving, or slightly more fun, the Halvening, sometime in the next 10 days, the amount of bitcoin generated for mining blocks will be cut in half. This has only happened once before in 2012, when the reward for mining a block dropped from 25 bitcoin to 12.5 bitcoin. The current change will mean that each result in bitcoin worth approximately $7,500 rather than $15,000.

Why Do I Care?

Bitcoin and its underlying blockchain are becoming more and more important. Current market capitalization of $10.03 billion is small compared to traditional currencies (also called fiat), however this is expected to grow. Noted VC Tim Draper (in)famously predicted in 2014 that Bitcoin would hit $10,000 by 2018. At $630 as of today, we are far from it – but the markets are getting more sophisticated and a return to $1,000 or more is possible in the near term.

More importantly, the world is going to be a very unstable place in the next 12 months. With the Brexit vote, calls for Frexit and other exits from the EU, a US election, stagnant global economic growth and capital flight from China, bitcoin has become a refuge for those seeking an uncorrelated investment that is outside the purview of government budget deficits and monetary policy. Politics aside, 2016 is shaping up to be a rocky year where financial markets are uncertain. Bitcoin is volatile, but it represents another way to avoid the vagaries of global political risk.

What is Actually Happening?

When you ‘mine’ bitcoin, your computer (or computing pool) competes to process ‘blocks’ of bitcoin transactions. These are verified and a ‘hashtag’ is amended to the block, at which point it is added to the general ledger or ‘blockchain.’ Whoever completes the hash first is awarded the bitcoin for that block. The Halvening means that instead of getting 50 bitcoins for solving each block, you only get 25. So basically you do the same work but only get half the reward.

What to Expect?

On its own, the Halvening will make mining less lucrative. By constraining future supply of bitcoin as demand increases bitcoin value should go up. However, it is not that simple. Bitcoin is very volatile – looking at a price chart form a bitcoin week is like looking at a chart for most stock markets for a year.

This being said, there should be upward pressure on bitcoin prices over the medium term. At the same time, continued global market uncertainty should increase interest and demand for bitcoin. In the near term some expect a sharp increase in bitcoin prices, some believe recent interest will wane and there will be a decline. What is clear is that bitcoin is here to stay and Brexit and other uncertainties will continue to drive more and more of the general public to take a look at bitcoin as a viable option for investment and for privacy.

This post was originally published on EdSappin.com